The minimum credit score required by Truist varies depending on the type of loan, but a representative didn’t provide specifics. Discount points, if you choose to buy them.During the preapproval process, you’ll receive a more customized quote - including your potential rate and monthly payment - based on your financial situation, down payment, the mortgage program you want to use, and other factors.īorrowers may also need to budget for closing costs, such as: So everyone won’t be able to qualify for the lowest rates. For instance, the 30-year fixed purchase rate quote assumes your credit score is higher than 740 and your down payment is at least 20%. These rates can change every day and are based on a few assumptions. A discount point, or mortgage point, is an optional upfront fee you pay in exchange for a lower interest rate. You can adjust the quotes by including zero discount points, 1 discount point, or 2 discount points.

/GettyImages-185268820-635e0e11508f4217b735a2387bf327c7.jpg)

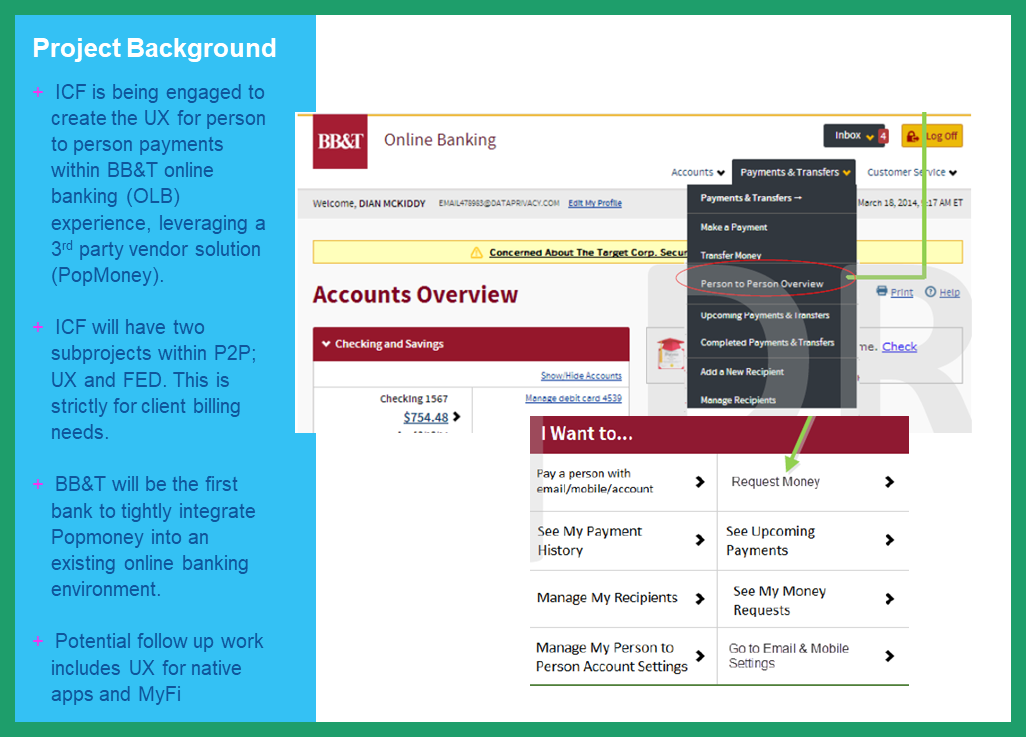

Truist advertises daily refinance and purchase rates for 15-year loans, 30-year loans, jumbo loans, VA loans, and FHA loans. You’ll find a detailed lineup of Truist mortgage rate quotes on both the SunTrust and BB&T websites. Truist (BB&T and SunTrust): Rates and Fees You can also call, email, or visit a branch to ask questions, get preapproved, or start a loan application.Īccording to a Truist representative, a typical purchase closing with the lender takes between 30 and 45 days, while a refinance closing takes about 45 to 60 days. You’ll find calculators, blog posts, videos, and detailed explanations of each mortgage program. Both websites are easy to navigate and offer several tools and resources to help borrowers through the mortgage process. SunTrust and BB&T are still merging under the Truist brand, so you can look at either website to find information - including rate quotes. Truist’s ARMs are subject to rate caps per adjustment as well as life of loan.Īnd if you have an existing mortgage, you can swap it out with a rate-and-term refinance, cash out refinance, FHA streamline refinance, VA cash-out refinance, VA IRRRL refinance, or USDA streamline refinance. So with a 5/6 ARM, for instance, the rate is fixed for the first five years then adjusts every six months. Truist offers ARMs with terms of 5/6, 7/6, or 10/6. Then, based on market conditions, the rate may go up or down at specified intervals for the rest of the loan term. An ARM offers a fixed rate only for a certain amount of time. This could be a good option if you find a low rate and you prefer predictable payments. With a fixed-rate mortgage, your mortgage rate never changes. Truist also gives homebuyers an option between fixed- and adjustable-rate mortgages. This type of loan has become popular as home inventory is shrinking but housing demand is increasing. After the home is constructed, the loan converts into a traditional 15- or 30-year mortgage. Department of Agriculture (USDA) loansĬonstruction-to-permanent loans allow homebuyers to finance the costs of building a new home.

#Bbt online banking overview full

Truist (SunTrust and BB&T) Mortgages Full Review For more information about our scoring methodology, click here. As with all of our mortgage lender reviews, our analysis is not influenced by any partnerships or advertising relationships.

0 kommentar(er)

0 kommentar(er)